47+ limitation on home mortgage interest deduction

Single or married filing separately 12550. See How Competitive Your Mortgage Payment Could Be.

Mortgage Interest Deduction Can Be Complicated Here S What You Need To Know For The 2022 Tax Season The Seattle Times

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Homeowners who bought houses before.

Yes you can include the mortgage interest and property taxes from both of your homes. 1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. However the deduction for mortgage interest.

It is not pretty but it works and provides the correct deduction. Web For 2021 tax returns the government has raised the standard deduction to. Ad Compare Mortgage Options and Rates Online.

The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax. Web Mortgage interest deduction limit. Apply For a Home Loan Online Today.

Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan. Web Web The key is that all of your mortgage interest is included with your tax return if your outstanding principal loan balance is below the maximum of 750000 or 1M. Web Among itemized deductions are the MID which grants homeowners the ability to deduct mortgage interest paid on either their first or second residence.

Web The IRS limits you to one qualified second home for mortgage interest deduction even if you havent met the limit of 750000375000. If your home was purchased before Dec. Web March 5 2022 246 PM.

Apply Today To Lock In Your Rate. Web Most homeowners can deduct all of their mortgage interest. Web March 4 2022 439 pm ET.

Web If youve closed on a mortgage on or after Jan. Web Currently the home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of principal on. 16 2017 you can deduct the mortgage interest paid on your first 1 million in.

Married filing jointly or qualifying widow er. Web Here is a work around solution that will fix your issue. How much mortgage interest.

Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

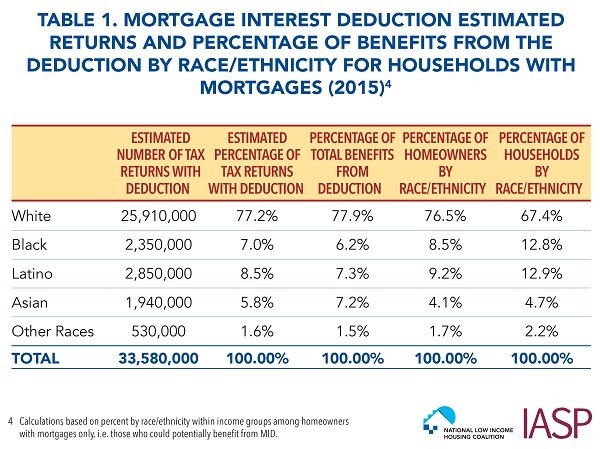

Race And Housing Series Mortgage Interest Deduction

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Deduction Can Be Complicated Here S What You Need To Know For The 2022 Tax Season The Seattle Times

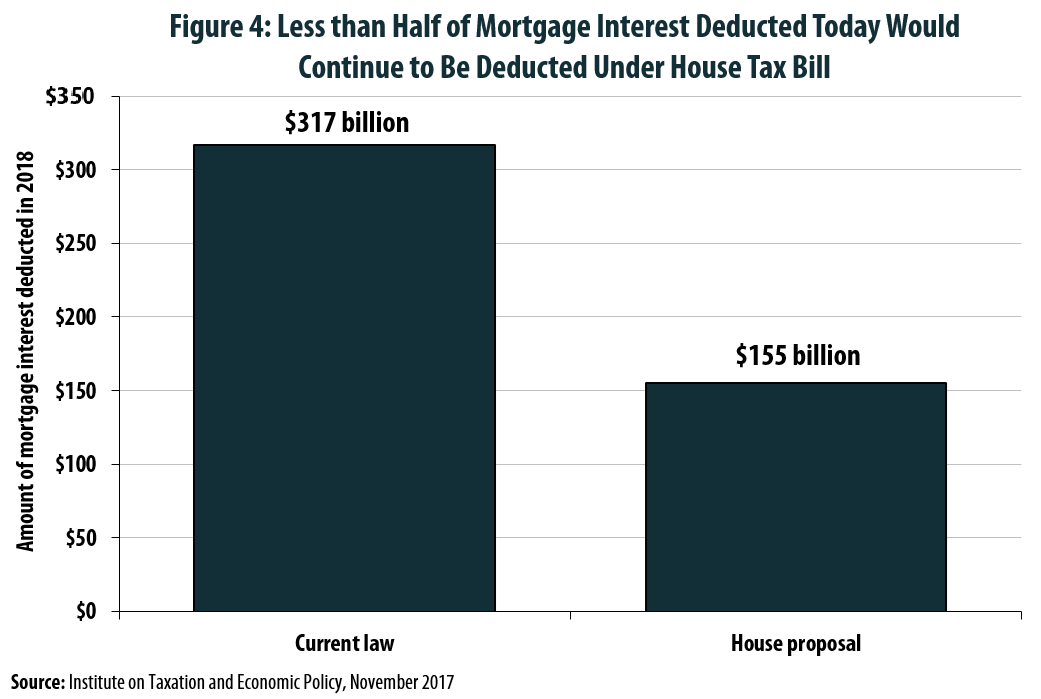

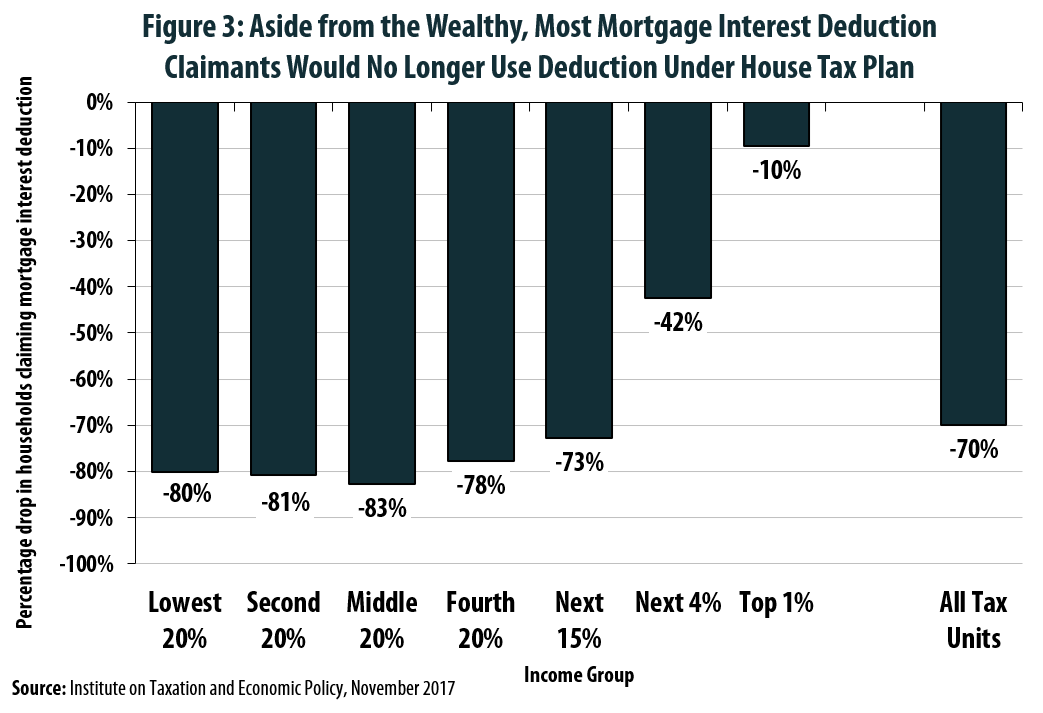

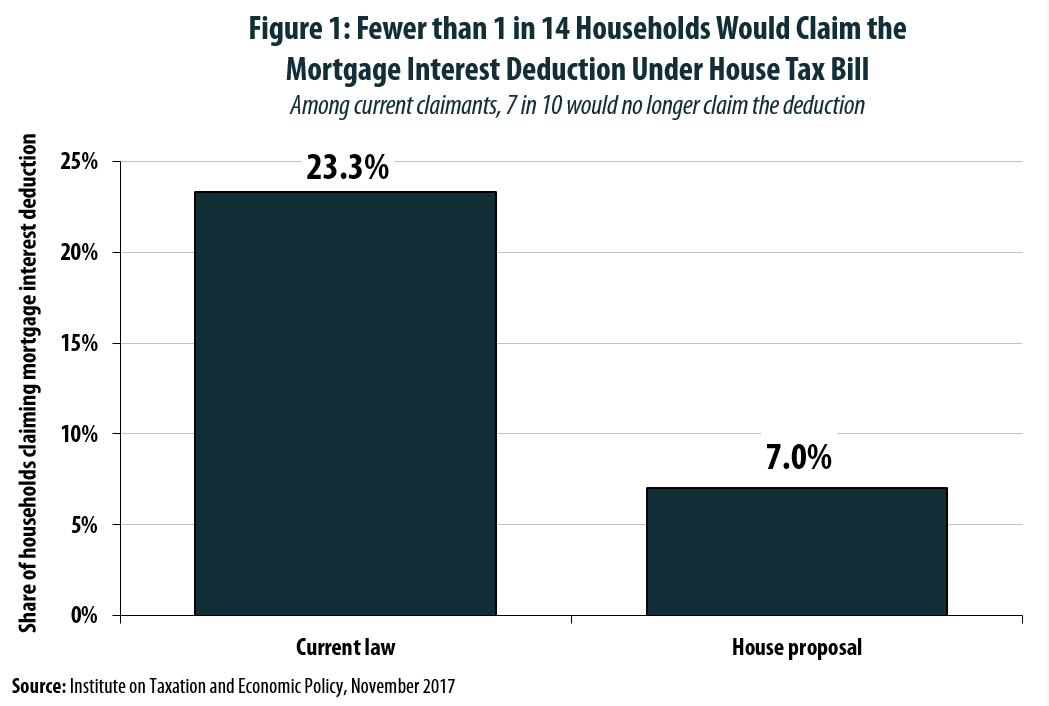

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Mortgage Interest Tax Deduction What You Need To Know

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Deduction Rules Limits For 2023

Mortgage Interest Deduction A 2022 Guide Credible

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

Home Loan Apply Housing Loan Online At Lowest Interest Rates Indusind Bank

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Limitation On Home Mortgage Interest Deduction Tax Law Changes 2018 Youtube

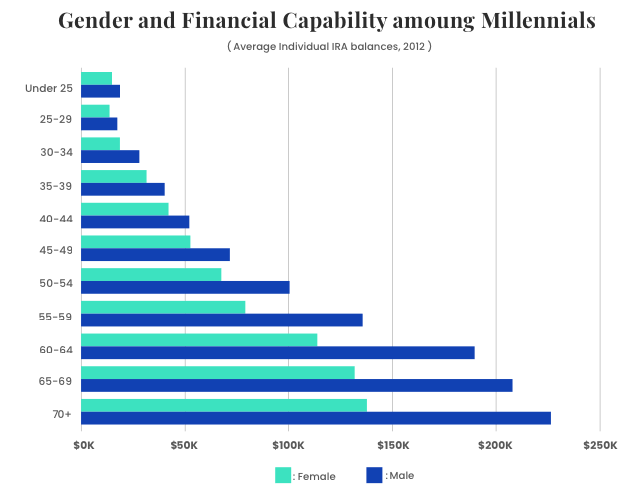

Women Financial Literacy Facts Resources Tips